Lina Dewi

ASSOCIATE GROUP DIRECTOR

CEA NO. : R016706E

For media enquiries, please contact corpcomms@propnex.com.

Latest Property Real Estate News - Published on 15/05/2024

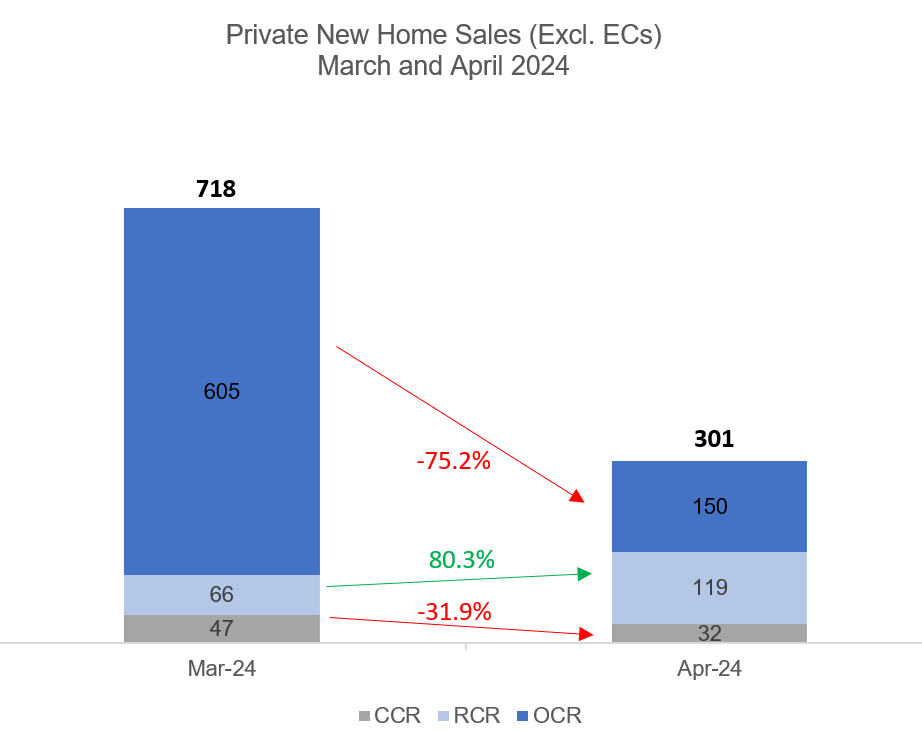

15 May 2024, Singapore - Developers' sales fell by 58% from March to April, as the number of new units placed on the market declined markedly, in view of the lack of major project launches in the month. New private home sales (ex. EC) came in at 301 units in April, falling from the 718 units shifted in March. The substantial drop in sales is also due to a higher base in March 2024, where developers' sales surged on strong demand at Lentor Mansion. When compared with the previous year, new home sales were down by 66% year-on-year from 890 units transacted in April 2023.

Only three fresh projects were launched in April, with two being boutique developments comprising fewer than 100 units - being the 14-unit 32 Gilstead and 59-unit The Hillshore. Meanwhile, The Hill @ One-North is a mid-sized project with 142 residential units. All in, developers placed a total of 278 new units (ex. EC) for sale in April - falling by 68% from the 877 units (ex. EC) released for sale in the previous month.

Source: PropNex Research, URA

The Outside Central Region (OCR) led sales in April, transacting 150 units (ex. EC) or 50% of the units sold in the month. However, on a month-on-month basis, the OCR sub-market posted the sharpest decline in sales, by about 75% from 605 units sold in March. The top-selling OCR project in the month was the 386-unit The Botany at Dairy Farm, which shifted 50 units at a median price of $2,004 psf - taking the overall take-up rate for the project to about 87%. Meanwhile, Hillhaven and a handful of projects in the Lentor area (Lentor Hills Residences, Lentor Mansion, and Hillock Green) which collectively transacted 65 units in April also added to the OCR home sales (see Table 3).

Over in the Rest of Central Region (RCR), developers sold 119 new units in April, marking an 80% MOM increase from 66 units in March, and the highest monthly sales in nine months in the RCR. The tally was boosted by The Hill @ One-North which was launched for sale in April; it sold 42 (or about 30%) of its 142 units at a median price of $2,614 psf. The next best-selling RCR project was Pinetree Hill which saw 18 units changed hands at a median price of $2,439 psf. A few other projects, The Continuum, Grand Dunman, The Landmark, and Blossoms by the Park also helped to prop up new home sales in the RCR. Newly-launched freehold development, The Hillshore sold 3 units at a median price of $2,599 psf.

Developers' sales in the Core Central Region (CCR) eased by about 32% MOM to 32 units in April. Only one CCR project made it to the top-10 sales list (see Table 3), being Watten House, which moved 7 units at a median price of $3,309 psf in the month. Since its preview sales in November 2023, Watten House has now sold 140 (78%) out of its 180 units. Meanwhile, freehold luxury residential project 32 Gilstead - which was launched in April - transacted 4 units at a median price of $3,443 psf.

In the EC segment, new sales fell by 55% from 114 units in March to 51 units in April. The most popular EC project in the month was North Gaia which moved 33 units at a median price of $1,315 psf, followed by Lumina Grand which sold 18 units at a median price of $1,516 psf. The 512-unit Lumina Grand which was launched in January 2024 is now about 72% sold. According to URA's figures, there are 329 unsold new EC units on the market as at end-April.

Please attribute the comments below to Wong Siew Ying, Head of Research & Content, PropNex Realty.

"The relatively muted sales in April were not unexpected as few projects were launched. In addition, the projects that hit the market are small- to mid-sized developments, and do not offer a wide selection of units to prospective buyers compared with the bigger projects that were launched in the previous month. Thus far, the largest project launched this year is Lentor Mansion which offers 533 units. With limited units put out in April, we saw buyers dipping into previously-launched projects for new homes. For instance, The Botany at Dairy Farm, which hit the market in March 2023 was the top-seller in April.

Developers' sales in May are anticipated to remain fairly tepid with only two boutique development launches - 21-unit Jansen House and the 16-unit Straits at Joo Chiat - in the month, and they will not be able to contribute meaningfully to overall sales in view of the small number of units available. In fact, with the school holidays coming up and people expected to travel, we may not see that many launches in June either. If so, we could potentially be looking at a sluggish Q2 2024, where new private home sales are concerned. We remain optimistic that developers' sales could pick up from Q3 2024 onwards, with the potential launch of larger developments such as Sora in Jurong East, Emerald of Katong in Jalan Tembusu, and The Chuan Park, amongst others.

The median unit price of new non-landed private homes sold in April climbed slightly by 2.5% MOM and 2.6% MOM in the CCR and RCR respectively, while the median $PSF price in the OCR fell by 6.7% MOM to $2,097 psf in April (See Table 1), as the transactions at Lentor Mansion had likely helped to lift the OCR median price in March.

Table 1: Median unit price ($PSF) of new non-landed private homes sold by Region by Month

| CCR | RCR | OCR | |

| Jan-23 | $2,884 | $2,589 | $2,083 |

| Feb-23 | $2,947 | $2,688 | $2,120 |

| Mar-23 | $2,920 | $2,614 | $2,065 |

| Apr-23 | $2,890 | $2,461 | $1,989 |

| May-23 | $2,919 | $2,525 | $2,154 |

| Jun-23 | $2,903 | $2,615 | $1,989 |

| Jul-23 | $2,902 | $2,499 | $2,087 |

| Aug-23 | $2,862 | $2,610 | $2,068 |

| Sep-23 | $3,115 | $2,535 | $2,070 |

| Oct-23 | $3,242 | $2,401 | $2,078 |

| Nov-23 | $3,195 | $2,563 | $2,336 |

| Dec-23 | $2,962 | $2,621 | $2,120 |

| Jan-24 | $3,182 | $2,576 | $2,079 |

| Feb-24 | $3,121 | $2,547 | $2,059 |

| Mar-24 | $3,244 | $2,532 | $2,248 |

| Apr-24 | $3,326 | $2,598 | $2,097 |

| Apr-24 MOM % change | 2.5% | 2.6% | -6.7% |

Source: PropNex Research, URA Realis (retrieved on 15 May 2024)

Table 2: Proportion of non-landed new private home sales (ex. EC) by nationality by residential status by month

| Nationality by Residential Status | Apr-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Oct-23 | Nov-23 | Dec-23 | Jan-24 | Feb-24 | Mar-24 | Apr-24 |

| Company | 0.1% | - | - | - | - | - | - | - | - | - | - | - | - |

| Foreigner (NPR) | 7.8% | 3.0% | 4.7% | 1.3% | 2.5% | 5.4% | 6.3% | 1.7% | 3.6% | 1.0% | 2.0% | 1.6% | 3.4% |

| Singapore Permanent Residents (PR) | 9.7% | 10.4% | 12.2% | 9.9% | 16.8% | 11.9% | 9.5% | 12.6% | 9.4% | 10.1% | 14.8% | 6.5% | 13.7% |

| Singaporean | 82.4% | 86.6% | 83.1% | 88.8% | 80.7% | 82.7% | 84.1% | 85.7% | 87.0% | 88.8% | 83.2% | 91.9% | 82.9% |

Source: PropNex Research, URA Realis (retrieved on 15 May 2024)

Owing to the softer sales volume, the proportion of new non-landed private home sales to foreigners (non-PR) ticked up to 3.4% in April compared with 1.6% in the previous month (See Table 2). The 3.4% portion in April represents 10 caveats in absolute terms - lower than the 11 caveats lodged by foreign buyers (NPR) in March 2024. The 10 units sold to foreigners (NPR) in April 2024 are at 19 Nassim, Klimt Cairnhill, Midtown Bay, Tembusu Grand, The Botany at Dairy Farm, The Continuum, The Hill @ One-North, and Watten House, according to URA Realis caveat data.

Since the tightening of the additional buyer's stamp duty (ABSD) measure in April 2023, the number of caveats lodged by foreigners (NPR) has declined sharply from 65 caveats in April 2023 to between 3 and 29 caveats in the subsequent months. From May 2023 to April 2024, each month saw an average of about 11 caveats for non-landed new private homes sold to foreigners (NPR).

Meanwhile, the proportion of non-landed private new home sales to Singaporean buyers eased to around 83% in April, while the portion of buyers who are Singapore PRs jumped to nearly 14% in the month. With the local market accounting for a lion's share of new home sales, we expect developers to price units sensitively at launch - keeping the price quantum palatable."

Table 3: Top-Selling Private Residential Projects (Ex. EC) in April 2024

| S/N | Project | Region | Units Sold in April 2024 | Median Price in April 2024 ($PSF) |

| 1 | THE BOTANY AT DAIRY FARM | OCR | 50 | $2,004 |

| 2 | THE HILL @ ONE-NORTH | RCR | 42 | $2,614 |

| 3 | HILLHAVEN | OCR | 22 | $2,080 |

| 4 | PINETREE HILL | RCR | 18 | $2,439 |

| 5 | LENTOR HILLS RESIDENCES | OCR | 16 | $2,113 |

| 6 | LENTOR MANSION | OCR | 15 | $2,230 |

| 7 | HILLOCK GREEN | OCR | 12 | $2,116 |

| 8 | THE CONTINUUM | RCR | 9 | $2,892 |

| GRAND DUNMAN | RCR | 9 | $2,681 | |

| 9 | THE LAKEGARDEN RESIDENCES | OCR | 8 | $2,228 |

| 10 | THE LANDMARK | RCR | 7 | $2,886 |

| BLOSSOMS BY THE PARK | RCR | 7 | $2,531 | |

| WATTEN HOUSE | CCR | 7 | $3,309 |

Source: PropNex Research, URA (15 May 2024)